Tax Reform

Kentuckians are worth good jobs, clean air and water, and quality education. We deserve healthy, vibrant communities, where everyone contributes their fair share toward our shared goals. Kentuckians For The Commonwealth is working for a day when the lives of all our people and communities matter before the profits of a very few.

This Kentucky is possible, but we need to reform our state taxes.

This Kentucky is possible, but we need to reform our state taxes.

KFTC works for comprehensive tax reform that is ...

-

FAIR. The responsibility of paying taxes should be shared so that everyone contributes their fair share. Low and middle income Kentuckians shouldn't be asked to pay more of their income to state and local taxes than the wealthiest citizens of the state.

-

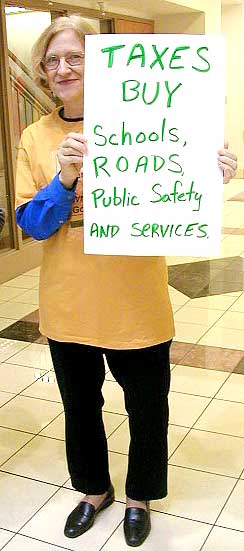

ADEQUATE. Our taxes are important investments in education, public safety, and health – services and structures that we all need.

-

And that PROMOTES THE WELL-BEING OF KENTUCKIANS.

Our friends at the Kentucky Center for Economic Policy have written extensively about what good tax reform looks like.

We have some work to do to get there

-

Our current tax structure disproportionately impacts lower- and middle-income Kentuckians. People who earn the least pay between 9 percent and 11 % of their income in state and local taxes, while Kentucky’s wealthiest 1% of income earners pay just over 6 percent. See the chart that shows this.

-

Our tax system has a "structural deficit," which means that until we reform it, Kentucky will never generate enough revenue to meet our current budget needs. This impacts our ability to invest in schools, clean drinking water, affordable higher education, and public health and safety.

Learn more about the problems with our current tax structure:

Here are some ways to help move Kentucky forward!

- Over the past couple of years (2018-19), the Republican-led General Assembly gave away more than $600 million in revenue, primarily through lower taxes on the wealthy and corporations, while raising sales taxes for everyone. Yet they say they can't find money for textbooks, maintenance at state parks, fully-funded mental health services and many other critical programs. Get involved and take action on our campaign action page.

- KFTC offers tax justice workshops to help people learn about our current tax and budget landscape and how to get involved in taking action for a better Kentucky. We'd love your help in hosting a workshop in your community! If you are involved with a faith group, community organization, school or even just a group of friends who want to sit around the kitchen table and learn more, get in touch with Jess Hays Lucas at [email protected] or 859-276-0563.

- Learn more about our Kentucky Forward Plan, comprehensive legislation to reform the state tax code.

Working for the Kentucky we deserve

What members are saying ...

"I look at the drastic cuts in things like public health and libraries, and fear for our future. We have to be better than this. And we have to be fairer ... We need solutions that benefit all of us, not just those who run major companies. We deserve investment in skills and education. In short, I’m another Kentuckian for tax reforms that raise adequate revenue and let everyone pay their fair share toward making Kentucky a great place to live and work."

"I look at the drastic cuts in things like public health and libraries, and fear for our future. We have to be better than this. And we have to be fairer ... We need solutions that benefit all of us, not just those who run major companies. We deserve investment in skills and education. In short, I’m another Kentuckian for tax reforms that raise adequate revenue and let everyone pay their fair share toward making Kentucky a great place to live and work."

Alan Smith

Bowling Green

“We live in an itty bitty community, and many families are  struggling. But I want to see my students have the same opportunities that other kids have. They deserve that. I want them to be exposed to culture and the arts, things that will give them experiences that make them excited to learn about the world...With all the information out there, it looks like we could create a tax system that’s more equitable.”

struggling. But I want to see my students have the same opportunities that other kids have. They deserve that. I want them to be exposed to culture and the arts, things that will give them experiences that make them excited to learn about the world...With all the information out there, it looks like we could create a tax system that’s more equitable.”

Elise Mohon

Taylor County

"I live in Scott County and I’m a parent, a retired public school teacher, and an active community member. I want to see every Kentucky child, especially those with special needs, have a quality education, and access to an affordable college education. I also want to see clean water and air, and I want it to be monitored so that we know it is safe. But right now our legislators are kicking the can down the road. They lack the courage to do their jobs to pay for these basic things.

"I live in Scott County and I’m a parent, a retired public school teacher, and an active community member. I want to see every Kentucky child, especially those with special needs, have a quality education, and access to an affordable college education. I also want to see clean water and air, and I want it to be monitored so that we know it is safe. But right now our legislators are kicking the can down the road. They lack the courage to do their jobs to pay for these basic things.

Rosanne Klarer

Scott County

Partners and Allies

KFTC works with a broad set of allies – faith communities, organized labor, education and health advocates, and community groups – to support tax reforms that meet our shared principles. If your organization is interested in joining the Kentucky Together Coalition, contact Tyler Offerman or sign up on their website.

- Home

- |

- Sitemap

- |

- Get Involved

- |

- Privacy Policy

- |

- Press

- |

- About

- |

- Bill Tracker

- |

- Contact

- |

- Links

- |

- RSS